Deferred Comp Limit 2024

Deferred Comp Limit 2024. Understanding irs contribution limits is important, especially when your goal is to contribute the maximum to your account. That's crucial info for participants in nonqualified deferred comp (nqdc) plans.

Cost of living adjustments may allow for additional. The 2024 section 415(c) limit is $69,000.

That's Crucial Info For Participants In Nonqualified Deferred Comp (Nqdc) Plans.

The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024.

Employees Can Invest More Money Into 401 (K) Plans In 2024, With Contribution Limits Increasing From 2023’S $22,500 To $23,000 For 2024.

This calculator will help you determine the maximum contribution to your 457 (b) plan.

Deferred Comp Limit 2024 Images References :

Source: katerinewcrissy.pages.dev

Source: katerinewcrissy.pages.dev

Deferred Comp Limits 2024 Catch Up Elsy, As part of a 457 plan, participants can contribute more than the annual limit once they reach a certain age. Understanding irs contribution limits is important, especially when your goal is to contribute the maximum to your account.

Source: www.pinnaclequote.com

Source: www.pinnaclequote.com

Business Life Insurance, The Truth About Deferred Compensation Plans, Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000. Even if you can’t do the max,.

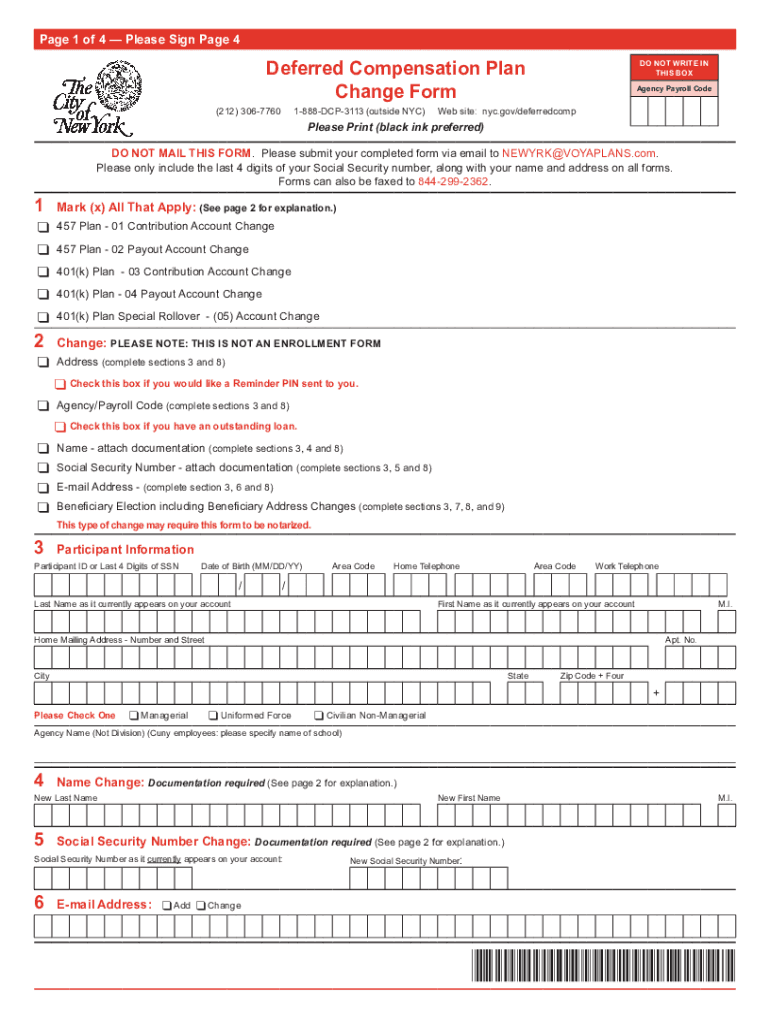

Source: www.pdffiller.com

Source: www.pdffiller.com

20212024 NY Deferred Compensation Plan Change Form Fill Online, 2024 tax brackets and standard deduction. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

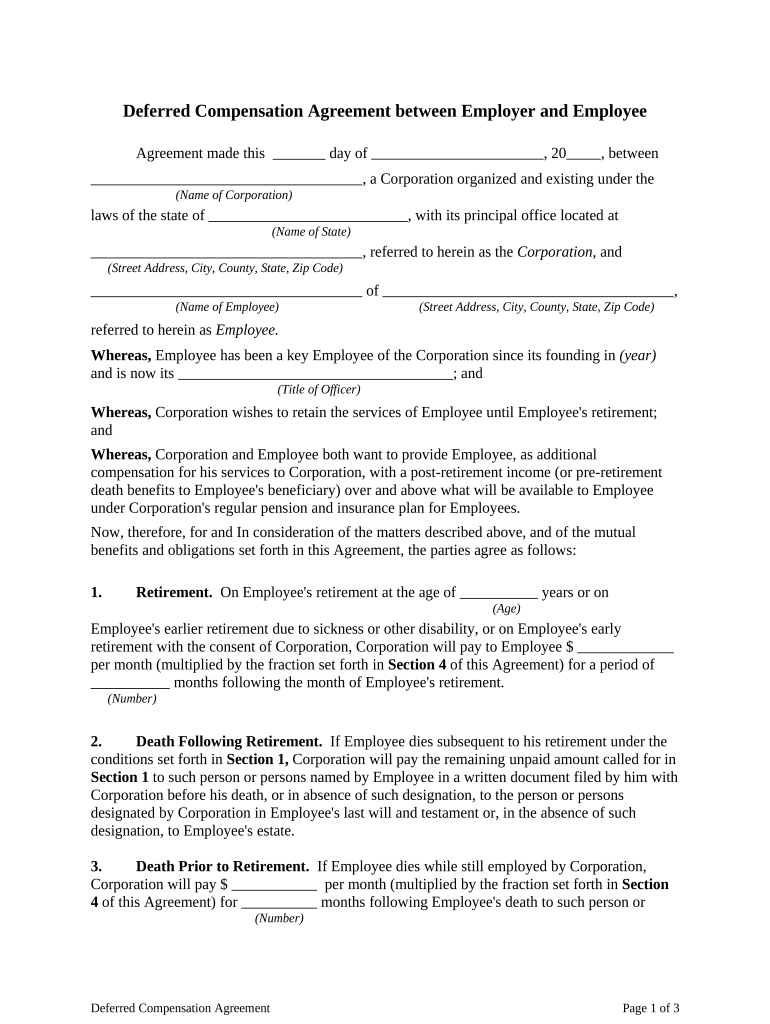

Source: www.dochub.com

Source: www.dochub.com

Deferred compensation agreement template Fill out & sign online DocHub, 2024 tax brackets and standard deduction. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

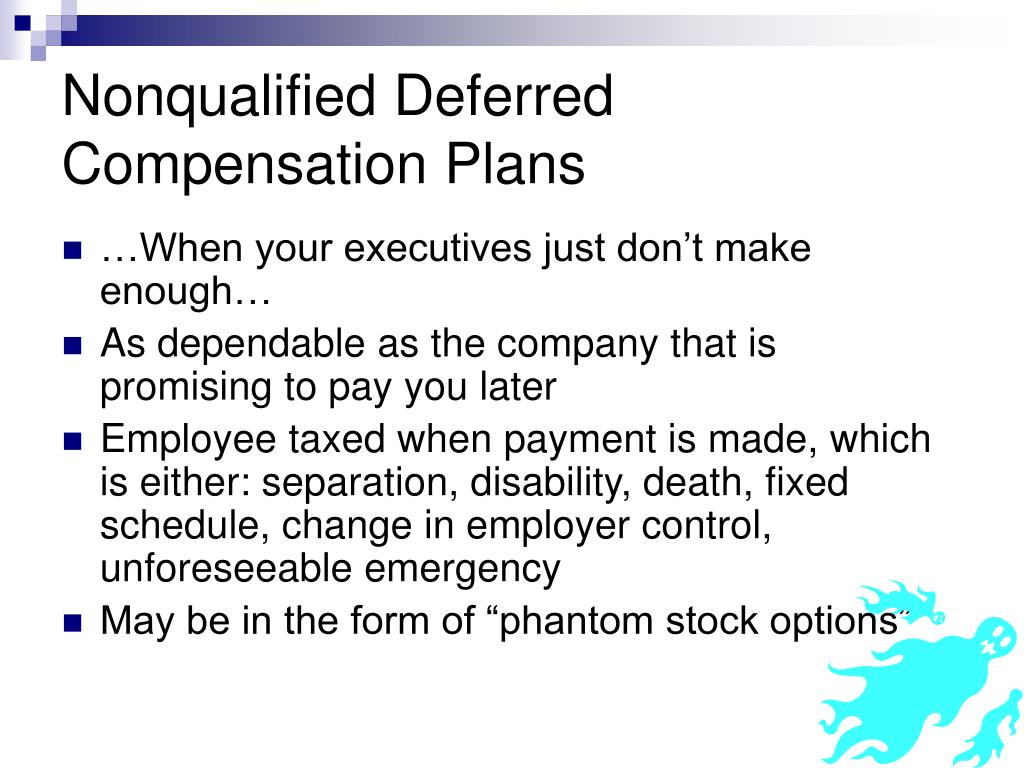

Source: www.slideserve.com

Source: www.slideserve.com

PPT Deferred Compensation PowerPoint Presentation, free download ID, The 2024 section 415(c) limit is $69,000. Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000.

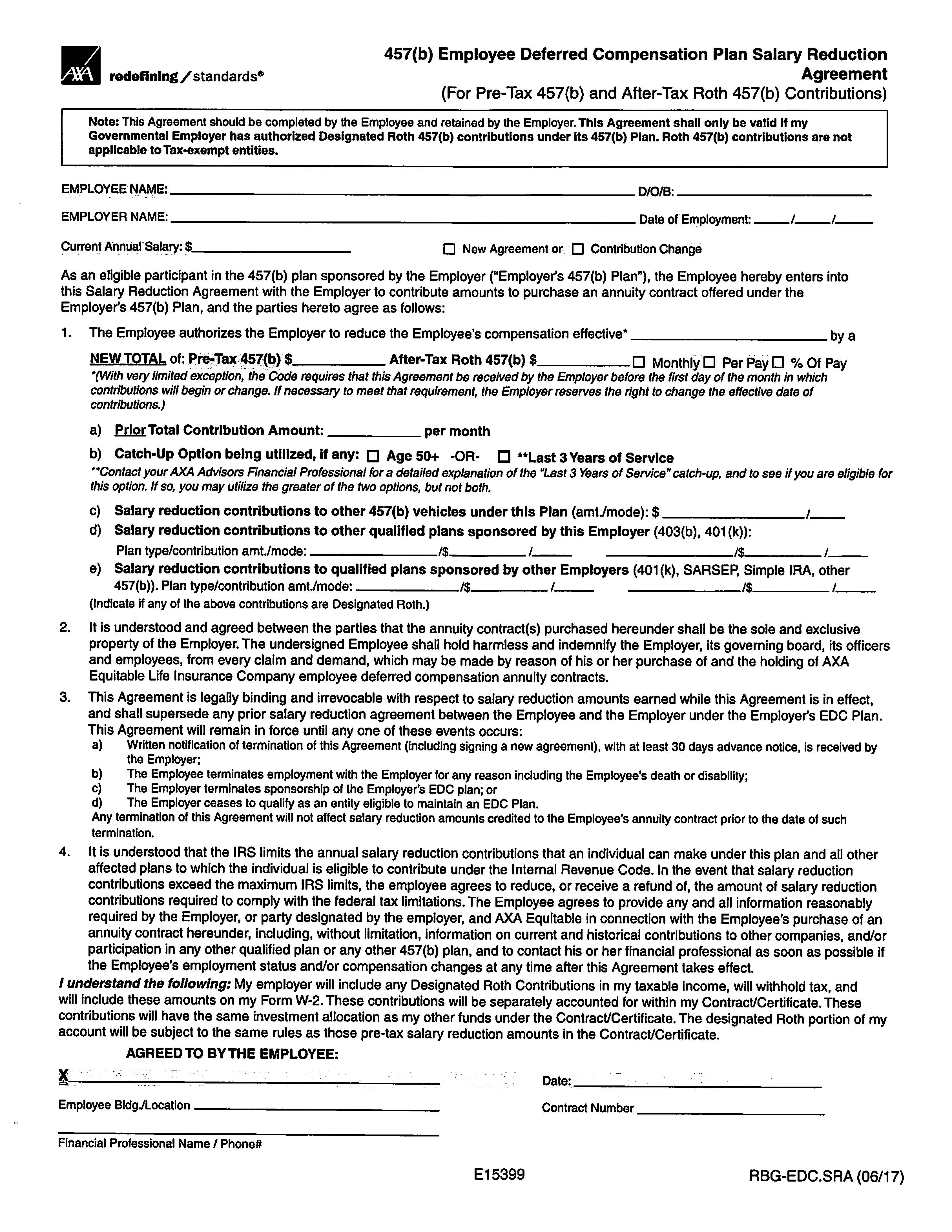

Source: gwynethwcasi.pages.dev

Source: gwynethwcasi.pages.dev

401k 2024 Deferral Limits Nesta Adelaide, The elective deferral limit for employees who participate in 401 (k), 403 (b), most 457 plans, and the federal government's thrift savings plan increases from. The irs just released the 2024 contribution limits on qualified 401(k) plans.

Source: www.countystat.info

Source: www.countystat.info

Deferred Compensation Memo for Employees, Cost of living adjustments may allow for additional. This calculator will help you determine your basic salary deferral limit, which, for 2024, is the lesser of $23,000 or 100% of includible compensation, reduced by any of the factors.

:max_bytes(150000):strip_icc()/deferred-compensation.asp-final-dbea1a436035487ab33e606efd74b861.png) Source: www.investopedia.com

Source: www.investopedia.com

What Is Deferred Compensation?, That's crucial info for participants in nonqualified deferred comp (nqdc) plans. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

Source: lasersonline.org

Source: lasersonline.org

Retirement Security LASERS, The 401k/403b/457/tsp contribution limit is $22,500 in 2023. The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024.

Source: www.canbyfinancial.com

Source: www.canbyfinancial.com

2024 retirement plan contribution limits, The elective deferral limit for employees who participate in 401 (k), 403 (b), most 457 plans, and the federal government's thrift savings plan increases from. Even if you can’t do the max,.

The Total Employee Contribution Limit To All 401(K) And 403(B) Plans For Those Under 50 Will Be Going Up From $22,500 In 2023 To $23,000 In 2024 (Compare That To The.

That's crucial info for participants in nonqualified deferred comp (nqdc) plans.

Cost Of Living Adjustments May Allow For Additional.

It assumes that you participate in a single 457 (b) plan in 2024 with one employer.

Posted in 2024